The world of e-commerce has long been the “beast” that beauty retailers and brands were trying to avoid. But the time has come to tame it?and the stakes are high for those that miss the opportunity.

People are shopping online for an ever-increasing number of products. Even product categories traditionally considered unlikely candidates for online shopping, including the beauty and personal care sector, have been swept up by the e-commerce revolution.

Beauty and personal care, an industry rooted in the ability to touch, smell, sample, and experiment with products in stores, is a rapidly growing segment of the $188 billion U.S. e-commerce industry. Convenient delivery, easy returns, a wider product selection, and access to other shoppers’ opinions, have created an attractive alternative?or at least a strong complement?to the in-store experience.

Beauty and personal care is a rapidly growing segment of the $188 billion U.S. e-commerce industry.

But what are consumers really looking for when they shop online, and more importantly, why are they shopping online? An A.T. Kearney study of online shopping in the beauty and personal care sector reveals the motivations, behaviors, and preferences behind this trend and highlights the implications for beauty brands and retailers.

Beautifying the e-Commerce Revolution

Although beauty and personal care e-commerce represented only a small percentage of U.S. online sales in 2011, the segment has been growing rapidly. Beauty e-commerce generated about $3 billion in sales in the United States in the past year, or roughly 4.5 percent of the $66 billion category. Considering how quickly e-commerce has spread in apparel and accessories, where touch and feel has long been considered a prerequisite, we believe beauty and personal care will soon follow suit and reach similar penetration levels.

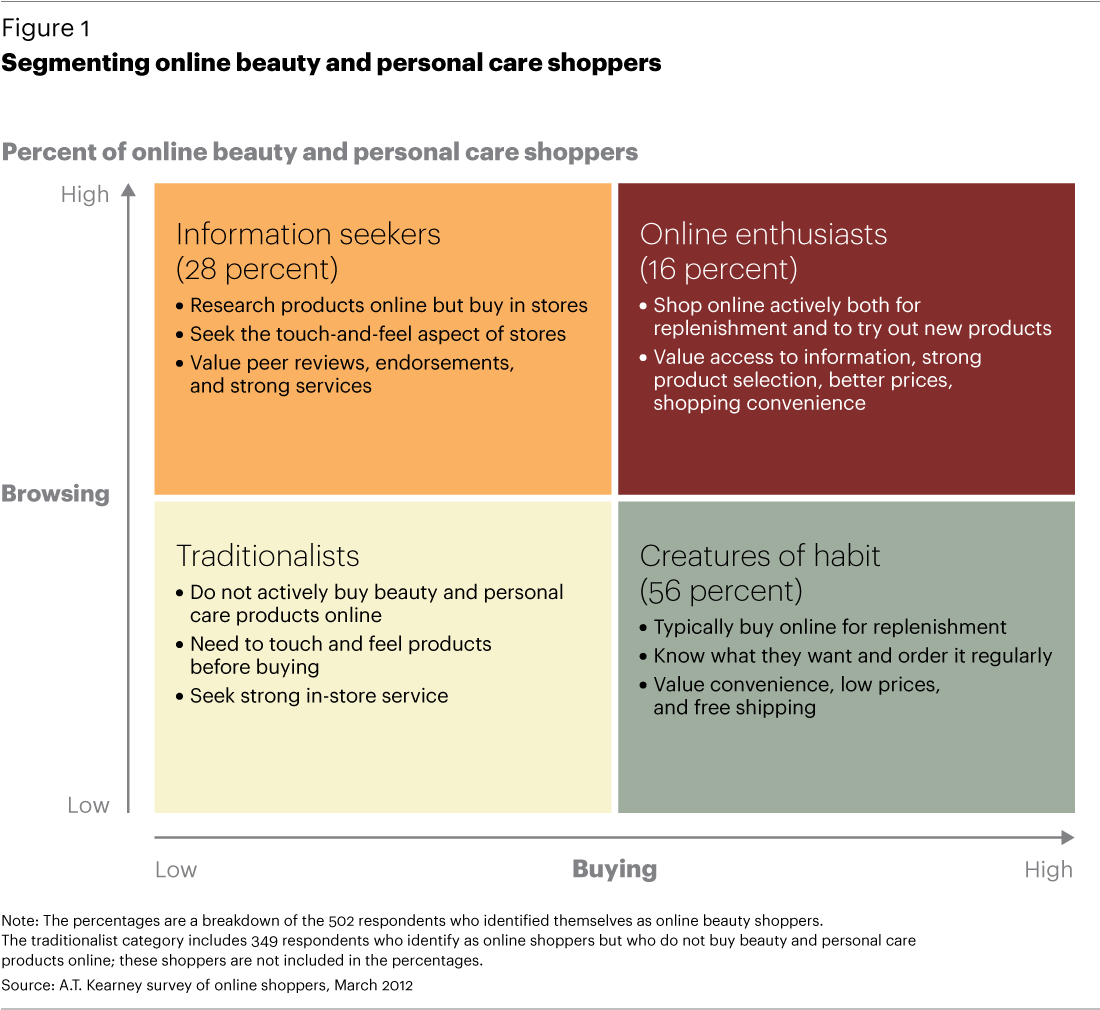

Who are today’s online beauty shoppers, and how often do they shop? What do they shop for, and what motivates them to shop online? Our study reveals four main customer segments in the beauty and personal care category.

Information seekers. This group, representing 28 percent of the 502 online beauty and personal care shoppers in our study, actively researches information online and carries that knowledge with them to stores where it is used to make more informed purchases. Sometimes the level of information these shoppers acquire online makes them more knowledgeable than the in-store beauty advisors, thus creating a new challenge for traditional retailers whose in-store support has customarily been a key differentiator.

Online enthusiasts. Roughly 16 percent of our survey respondents are online enthusiasts, motivated as much by the ability to gather information online as they are by the opportunity to purchase their favorite and new products conveniently and at better prices. These shoppers not only seek information but also interact, post reviews, and make online purchases.

Creatures of habit. This group of respondents is the largest (56 percent) and comprises shoppers who know what they want and are comfortable regularly replenishing their product needs from online sites. They are motivated by convenience and price and typically shop monthly on trusted online retail sites rather than explore and experiment with new opportunities on the Web.

Traditionalists. In addition to the 502 shoppers who purchase beauty and personal care products online, our sample included 349 respondents who shop online for categories other than beauty. These are consumers who need to touch, explore, and shop for beauty and personal care products in a brick-and-mortar store. Brands and retailers cannot ignore this large group of buyers, even as they continue to shop for beauty and personal care in stores. This group is generally affluent, typically female, and actively shopping online in other categories such as fashion and accessories. However, the need to touch and feel beauty products surpasses that need in other categories. For this group, beauty and personal care ranks among the highest of social shopping categories, where the desire to shop and explore these products in person remains strong.

What Consumers Want

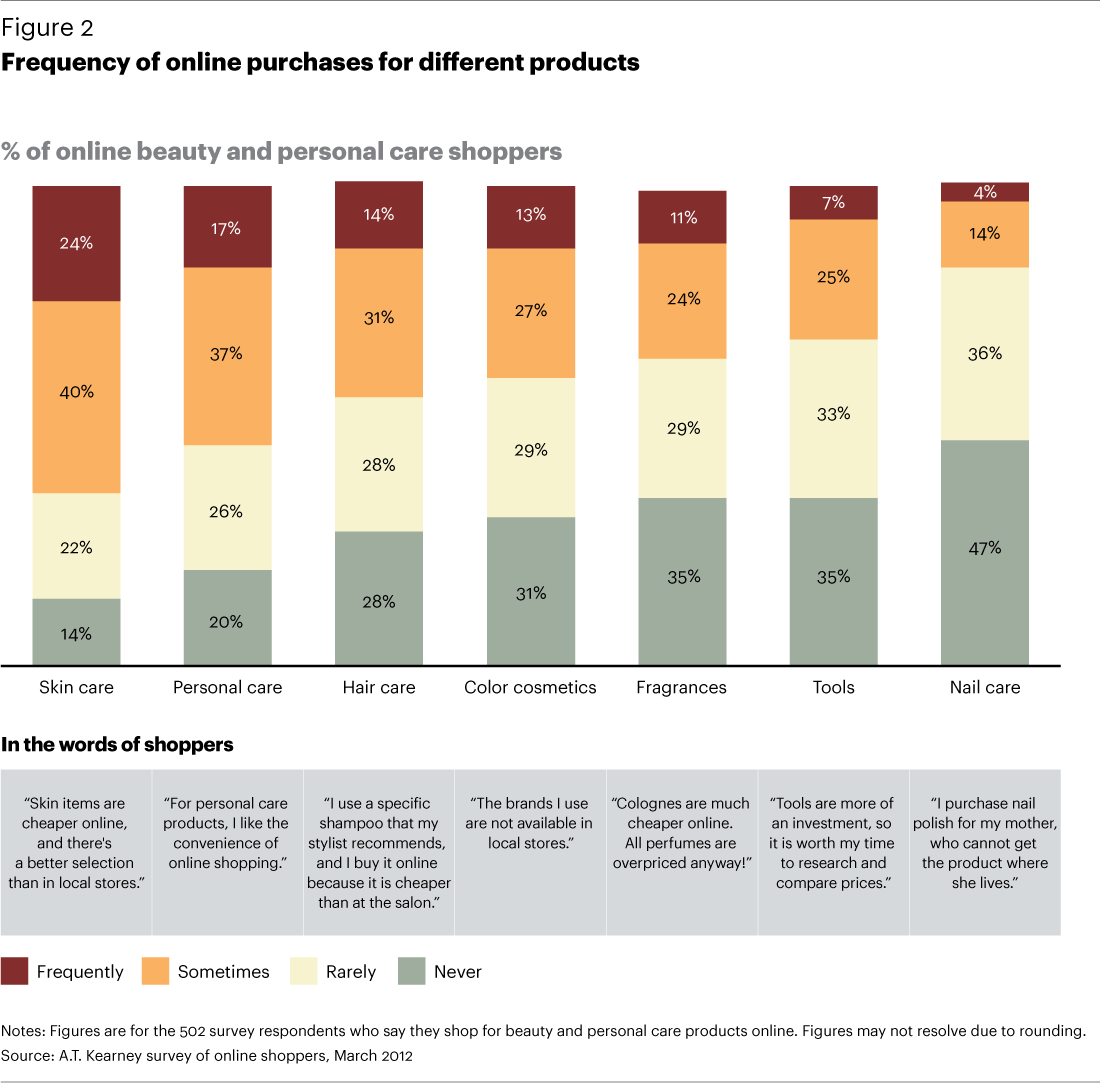

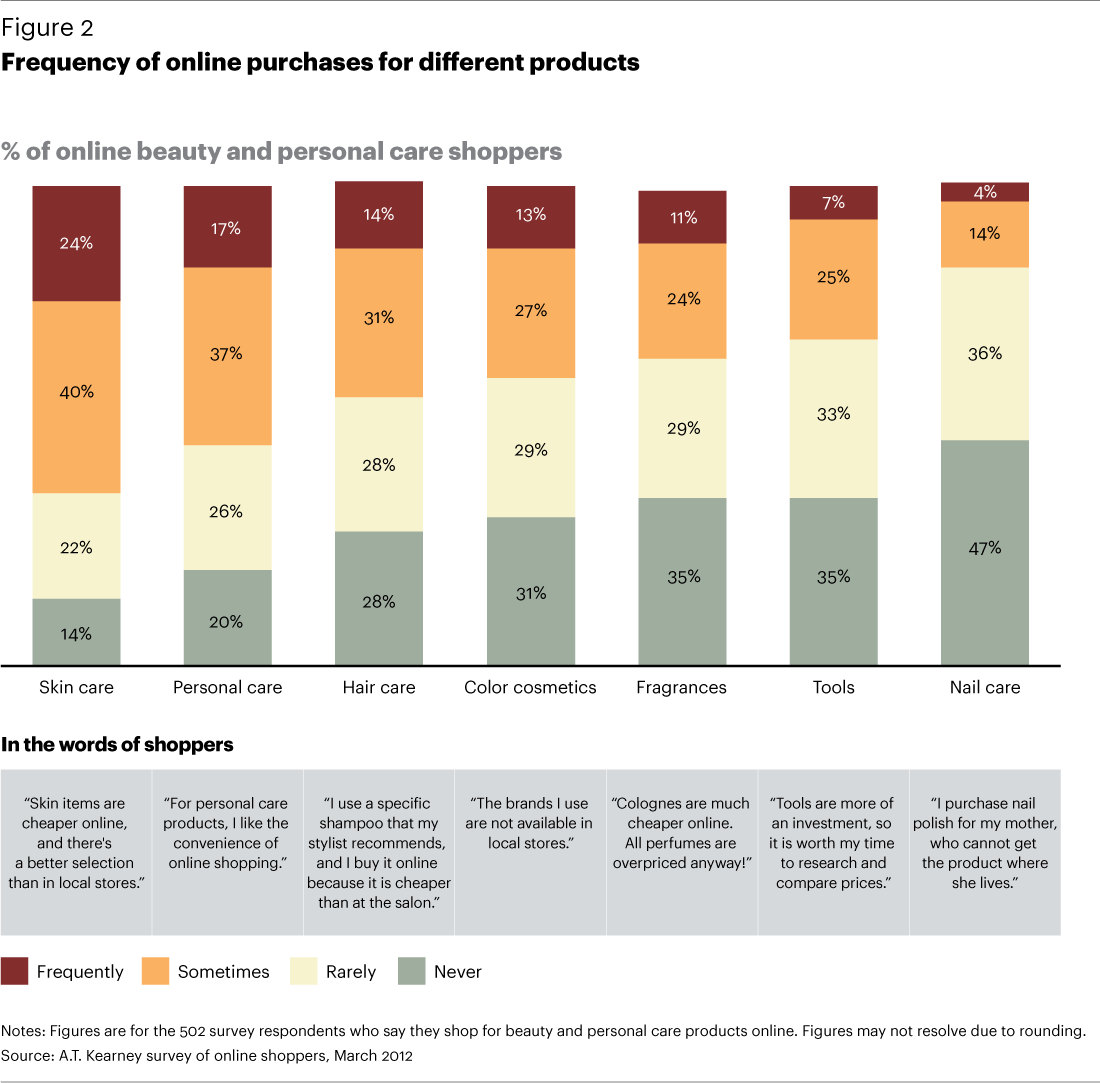

Skin care, personal care, and hair care, staples in most personal regimens, score highly in e-commerce buying, making up the top three categories for our survey respondents. In short, when they know what they want, they readily shop online, motivated primarily by price and more (and better) product choices. One survey participant’s reason for shopping online is that “skin care items are cheaper,” while another says she finds “a better selection of products online than in stores.”

By comparison, categories that are subject to regular experimentation and exploration, such as fragrances and color cosmetics, enjoy relatively less online penetration. Here, there is still a general desire to touch these products, experiment, discuss, and consult with friends and family. Although online businesses are increasingly offering services such as online beauty advisors, free samples, peer reviews, and plug-ins to social networks, these features are still not adequate substitutes for what consumers seek in stores. The reasons range from the expected? “I need to be able to smell the fragrance before I buy it” and “colors as shown online often do not match precisely with the actual product”?to the more nuanced: “Shopping for makeup is a social ritual for me. I like to go with my friends and see what’s new.”

Up to 13 percent of our shoppers frequently buy from these categories online, and up to 27 percent sometimes do.

We also asked participants to rate the online shopping attributes that are most important to them. Of the 14 attributes listed, the more utilitarian ones such as product and brand availability, free shipping, price, and site security rank as most important, while features that make for a better online shopping experience such as online beauty advisors, loyalty points, peer reviews, and even free samples do not rate as very important (see figure 3). This is most likely because the majority of online shoppers in this category are replenishment shoppers who already know what they want and are more interested in a trouble-free online shopping experience than advanced features or information.

Although important attributes do not vary significantly by gender, income, or age, men do not generally rate all attributes as important as women do. For every eight out of 10 women who rate an attribute as important to their online shopping needs, only five out of 10 men rate the same attribute as important. Price is the only exception, with men rating price as very important more often than women. In terms of age, younger consumers (under 25 years old) rate interactive and social elements such as peer reviews and online advice as important more so than older consumers.

Finally, we examined how much consumers spend and how they spend it. In our sample, consumers spend between 33 and 44 percent of their monthly beauty budget online, and online penetration increases as income increases (see figure 4). These findings reveal an interesting insight: Even for online shopping-savvy consumers, brick-and-mortar shopping is far from dead. In fact, for those spending an average $24 monthly on beauty and personal care products, 67 percent of their budget is spent in stores. For the higher spending group ($40 monthly), 57 percent of their budget is spent in brick-and-mortar stores. Such a clear consumer preference of retaining physical stores as a vital part of their shopping needs presents important implications for brands and retailers.

Higher-income beauty and personal care consumers are more likely to shop online

Where Shoppers Shop

No study of online shopping is complete without an analysis of where shoppers shop. We found some expected results along with some surprising responses about online beauty and personal care shopping destinations.

General and specialty online aggregators?such as Amazon, drugstore.com, and eBay?have the clear edge for online shopping in the beauty and personal care sector. And, as with most other categories, Amazon remains the leader with 28 percent of our survey respondents rating amazon.com as their top destination for online beauty and personal care shopping (see figure 5). The main reasons Amazon holds this position are convenience, free shipping (increasingly cited in conjunction with its membership program, Amazon Prime), a vast selection of products and brands, and one-stop shopping with the ability to combine orders across categories. Zeroing in on the male segment of our consumer sample reaffirms Amazon’s place in men’s choices: 53 percent of all men rate Amazon as their top destination.

Top online destination for beauty and personal care shoppers

Sephora scores a respectable second place, with 18 percent of all online shoppers in our sample set (and 23 percent of all women in the survey) ranking it as their top online destination. Sephora wins marks on the experience qualities of its online and mobile interfaces, the ability to seamlessly serve consumers across channels, product selection, free shipping for purchases of $50 or more, an annual 20 percent off sale, and its innovative loyalty program.

Closing out the list of online aggregators, drugstore.com and eBay rank third and fourth, garnering 8 and 7 percent of votes respectively as the top online destinations for beauty and personal care.

While the e-commerce revolution creates a powerful channel for brands to reach their customers directly, brand-direct beauty and personal care sites such as BareEscentuals and Clinique are capturing only a sliver of the market (10 percent across 17 brand-direct sites). Online shoppers who go to these sites say the main reasons are special offers and access to products they cannot find elsewhere.

However, as the demand for beauty product online increases, we are observing a less than perfect picture. When asked what they don’t like about shopping online, some say unpredictability in products. “I bought the entire SK-II skin care product online, which ended up being fake,” explains one unhappy customer. Third-party sellers are creating an undercurrent that signals a lack of control over brand messaging, brand pricing, and brand integrity.

Taming the E-Commerce Beast

As the market continues to expand and consumers become more savvy, brands and retailers face undeniable implications for their future. Those that follow three guiding principles will create a strong foundation for a good-looking future:

Create a seamless multichannel experience. While every retailer and brand understands the need for and is actively adopting e-commerce strategies to meet customers wherever they are, much debate remains about what the right strategy should be. The answer lies in harnessing all available platforms to create an integrated experience as the customer moves across channels.

Online shoppers rank product availability, free shipping, and price as the most important features of online shopping.

Channels need to build on each other, allowing consumers to seamlessly move between them and cumulatively build their overall brand experience. Secondly, the in-store experience has to draw people in. It is no longer only about the transaction. Although the online transaction is generally much more efficient and convenient, beauty and personal care shoppers still come to stores for hands-on experience with products. The social experience needs to be amplified. Product testers and samples in stores will become increasingly important. Once a customer tries something and likes it, he or she will readily convert into an online replenishment shopper. The value of the brick-and-mortar store thus increasingly gravitates toward introducing consumers to new products and brands, service, and differentiation.

Upping the ante on education for in-store beauty advisors and personnel will be key. Today’s consumers, armed with information gathered online when they visit stores, are at times more educated about products than the staff, which presents a real challenge for stores. Implementing dynamic training programs and opportunities for store staff to converse with customers online and off will separate the leaders from the followers.

Develop innovative partnerships to maintain brand control. As exciting as the online marketplace is for beauty and personal care, it brings with it inherent challenges to maintain brand control. Brands can become online category captains working with retailers and online aggregators to manage and grow the overall category and ensure their brands are adequately presented on various sites.

Develop dynamic marketing strategies for the new online shopper. Even as shopping channels continue to multiply, the basic principle of retailing, merchandising, and marketing remains intact?connecting with consumers. The e-commerce revolution offers a powerful way to do this. The level of data available in the online world enables us to know exactly who our customers are, what they view, and when they buy, opening the way for an even more powerful reality?one that enables advanced behavioral segmentation, dynamic pricing, and vibrant online content that empowers retailers and brands to grow past traditional marketing strategies and create real-time and personalized campaigns to reach consumers in new ways.

So there we have it: beauty and the e-commerce beast. Retailers and brands that can work together to seamlessly deliver a vibrant online experience to their target consumers will tame the beast, separating tomorrow’s winners from yesterday’s has-beens.

(Source: A.T.Kearney – Survey Of Online Shoppers, March 2012)